The recent announcement that the NZ Super Fund was considering investing in the Government’s proposed Auckland light rail networks has re-ignited calls for KiwiSaver to be used to fund local infrastructure investments.

On the surface, the case for investment in long-term infrastructure assets appears compelling. Infrastructure projects are long-term, defensive investments that often come with monopolistic characteristics.

Historically, many infrastructure projects have offered compelling rates of return.

Auckland alone is estimated to need $7 billion in infrastructure spending over the coming decade as the city expands by the size of Tauranga every three years (1).

KiwiSaver, being a long-term investment vehicle with over $46 billion in funds, appears well placed to help fund these projects.

But like many things in finance, when subject to rigorous analysis, cracks appear. There is no reason why infrastructure assets offer superior returns.

Over the long-term, sector analysis shows infrastructure assets offer no better or no worse rate of return than any other sector of the economy such as healthcare, media or telecommunications.

The perception that infrastructure projects offer superior returns may come from the use of leverage. Because infrastructure assets are long-dated and defensive in nature, banks and private bond holders have traditionally been willing to lend a considerable amount of a project’s cost.

But debt turbo charges losses as well as profits, as investors in RiverCity Motorway Group, which funded construction of a toll road in Brisbane, found out when it went bankrupt in 2011 after traffic volumes fell short of projections.

However, the biggest problem with funding a project like Auckland’s light rail through KiwiSaver is liquidity and asset pricing uncertainty.

The Guardians of New Zealand Superannuation can consider long-term private market assets like forestry partnerships or an infrastructure project because they have a single long-term client who is unlikely to withdraw their capital at short notice.

In contrast, KiwiSaver is made up of 2.8 million individual accounts, each with its own time-frame and agenda.

Last year alone $614 million was withdrawn for first home purchases, $81 million for hardship and $631 million by retirees. More importantly, there are now over 240 options for KiwiSaver members to choose between.

Switching schemes is costless and quick, as long as the underlying assets are accurately priced and liquid.

What happens, however, when the clients of one scheme holding a long-term illiquid infrastructure investment decide to switch to another scheme? Private market assets are both difficult and expensive to price, so pricing is only reviewed periodically.

Even where there is a recent ‘price’, there is often no ability to transact at that price. When a private market investment is successful, existing unit holders may suffer from undervalued asset prices as their investment is diluted by new investors entering the fund.

Even worse, if a private market asset goes bad, then it’s “first out, best dressed”.

This means the first investors to exit the fund will get a better price than those left behind. If a fund shrinks too fast, illiquid assets can grow in weight, even as they fall in value, as they cannot be sold to fund redemptions.

In the end, this leads to the fund being frozen, to prevent investor inequality, until the fund is wound down by selling the illiquid asset (or the asset is written off). This process can take years.

You do not have to cast your mind back very far to find a strikingly similar situation of liquidity mismatch.

Finance companies were billed as offering New Zealanders a superior rate of return to term deposits, for a “first ranking debenture” on long-term stable infrastructure like assets, in that case property.

Unfortunately, investors had the right to periodically withdraw their funds, while the underlying projects required years of funding to come to fruition.

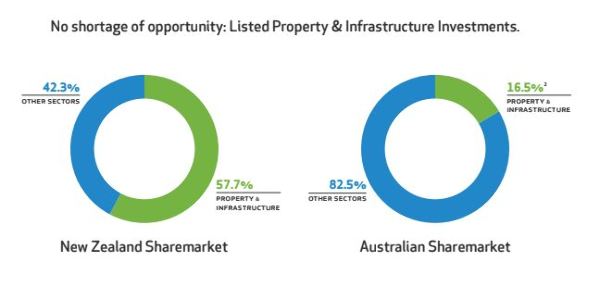

There is absolutely no reason why KiwiSaver cannot be used to fund long-term infrastructure projects, as long as they are listed. The purpose of the share market is to provide companies with a source of long-term capital and investors with transparent pricing and daily liquidity.

The listed market also provides KiwiSaver investors with rigorous regulatory oversight, strict governance standards and continuous disclosure rules, all of which do not apply to private market assets.

Auckland International Airport, Port of Tauranga and Chorus are three excellent examples of listed entities which have used the share market to fund long-term New Zealand infrastructure investments.

Interestingly, there is currently no restrictions on KiwiSaver schemes investing in illiquid, private market assets, as long as they are ‘disclosed’ to investors. It is not a requirement to disclose the overall level of indebtedness, governance standards, duration of the project, or future funding requirements, or to provide the market with continuous disclosure. To date, a number of providers have taken advantage of this by purchasing private market assets.

Requiring KiwiSaver managers to invest members’ funds in marketable assets with liquidity would in no way detract from the ability for KiwiSaver to be used as a source of long-term infrastructure capital, but it would significantly enhance the structural integrity of KiwiSaver. KiwiSaver is not New Zealand’s first attempt at funding our retirements, but to date it has been our most successful, thanks to the growing relationship of trust between the public and the managers of their assets.

Anything that threatens this relationship of trust should be prohibited.

1. The Nation, Interview with Phil Goff, 3 June 2017.

2. Source: NZ Funds analysis: New Zealand Sharemarket sectors include Property, Infrastructure, Utilities, Retirement Villages, Chorus, Spark and New Zealand Refining. Australian Sharemarket sectors include Property, Infrastructure and Utilities.