As the end of the decade draws closer, independent advisers face a dual threat: further regulation and lower returns.

While considerable debate surrounds the introduction of the new rules for financial advisers, returns may prove the bigger threat to incomes. How advisers and managers navigate these dual threats will likely determine who the industry’s winners and losers will be.

Low returns are an insidious threat. Investors, and their advisers, have enjoyed a great run. Since the end of the Global Financial Crisis in March 2009, investors have enjoyed strong investment returns, both here and internationally. The NZX50 Index has risen 317%, while the global share market (MSCI ACWI Index) has returned 245%. During the same period (March 2009 to August 2018) New Zealand and international interest rates have fallen, generating capital gains for long-term bond holders.

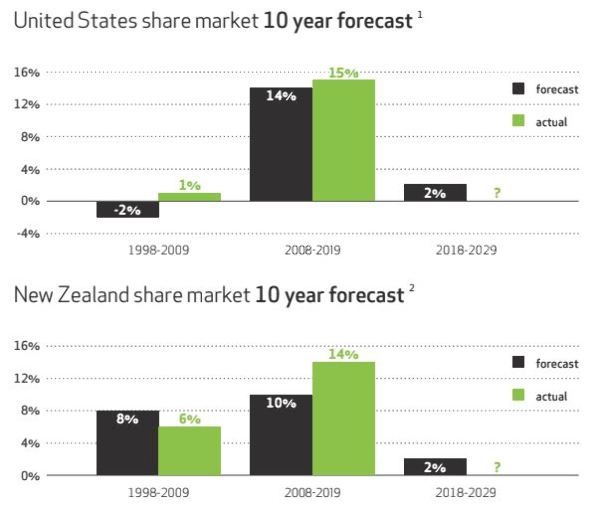

Share and bond valuations indicate that both asset classes are now between 1.3 and 2.4 standard deviations above their long-term average. Put simply, both bonds and shares are expensive. The corollary of a decade of above average returns is that advisers will need to navigate a period of below average returns. NZ Funds, with the help of US Strategist Barry B Bannister of Stifel Nicolaus, estimate 10-year equity returns will average 2%, less than the 14% enjoyed over the last decade.

Unfortunately, while valuation is a reliable predictor of long-term returns, it is of little use in timing markets or in predicting what form returns will be delivered over the coming decade. Below average long-term returns come in two forms. Markets can either deliver weak returns though a decade-long sideways movement, creating a war of attrition during which clients slowly lose faith and seek out alternative asset classes like cash and property. Investment advisers in the United States faced just such a period between 1976 and 1982, while New Zealanders experienced a similar decade following the 1987 crash.

The alternative is that markets will continue to rally strongly, only to slump later, giving up most of or all the decade’s gains. Many advisers will remember the vintage of clients who invested in global shares during the strong rally that preceded the 2000 equity market peak and who by 2010, despite enduring a rollercoaster of volatility, had earned nothing more than the return of their capital. Little wonder that during this period advisers and managers sought to maintain client returns through alternative forms of investments – such as infrastructure, private equity, structured credit and finance company debentures – with mixed results.

In the past New Zealand equities have provided something of a safe haven. During the period 2000 to 2009 when global equities delivered an annualised loss of 0.5%, New Zealand shares outperformed most other developed countries, delivering an annualised return of 7.1%. This strong return was almost entirely due to the high dividends paid by New Zealand companies at that time.

Fortunately (or unfortunately), New Zealand shares’ outperformance has continued. From 2010 to August 2018 New Zealand shares have risen 222%, outpacing global shares by 94% over the same period. Today, New Zealand shares trade at a premium to global shares, implying the average New Zealand business will outperform the average American company. Even if this were to occur, overall valuations in both countries still imply low returns for a decade.

The upside for advisers is that financial advice will have a larger impact on long-term client wealth than over the previous decade. When New Zealand equities are compounding at 14% a year, clients can more than double their wealth every six years, and multiply it over sevenfold every 15 years. Whether clients save at 3%, 6% or 9% makes little difference. However, when returns compound at 2, 3 or 4% a more aggressive savings strategy becomes the only way to meaningfully increase clients’ wealth over the same time frame.

Further, with the return of volatility, clients are more likely to need counselling as markets crash and rebound. Similarly, ensuring clients own a well-diversified portfolio and have not become overextended in one asset class, as they are prone to do when DIY investing, will rise in importance.

Another strategy for advisers, to add value to their client base, is to plan to provide clients with a broader range of financial services. Following the introduction of a similar licensing requirement in Australia, many advisers moved from selling only one financial product to offering a “triple stack” of services, and in particular: mortgages, insurance and retirement saving advice.

Irrespective of how advisers tackle the coming decade, valuations suggest they have an important role to play. Perhaps it is fitting that the final word goes to financial engineer of the last decade, Ben Bernanke: “Smart financial planning, such as budgeting, saving for emergencies and preparing for retirement, can help households enjoy better lives while weathering financial shocks”.

Michael Lang is Chief Investment Officer at NZ Funds.

New Zealand Funds Management is the issuer of the NZ Funds KiwiSaver Scheme.