Is regulated financial advice of value?

In 1989, to keep me out of trouble, my parents sent me to school in Berlin. To their horror, shortly after I arrived, the Berlin Wall fell. One of my more vivid memories is of visiting my first East German supermarket with only one brand of anything on the shelf. One brand of baked beans, one brand of soap, no shampoo.

One of the great things about a free market, is choice.

The choice of organic beans, budget beans, New Zealand beans or imported beans. Of course no one wants to eat poisoned beans, or expired beans, so rules and regulation are essential. The system breaks down when the choice and preferences of any one group are imposed on many.

Many New Zealanders do not realise that they have a choice between two fundamentally different types of KiwiSaver schemes: those that come with advice and those that do not. In general, those that provide more charge more and those that provide less, well, charge less.

Who can be an adviser?

Anyone can call themselves an adviser, but when it comes to giving KiwiSaver advice you must be either a Registered Financial Adviser (RFA) or an Authorised Financial Adviser (AFA). Both require training and are subject to regulatory oversight. RFAs may give class advice, akin to general information about a product, while AFAs are able to take a client’s personal circumstances into account and customise their recommendations.

What constitutes advice?

At one end of the spectrum advice helps educate investors about the benefits of KiwiSaver, such as how to access the annual member tax credit of $521 or how to take a contribution holiday. All schemes provide this information, but how it is delivered varies widely from scheme to scheme.

Moving along the advice spectrum at one end, is advice from RFAs which can help match clients with an investment which is appropriate to their age and stage. At the other end, AFAs alone are able to help clients tackle more challenging questions such as: What are the options for my retirement? How much of that will be met through home equity and how much through KiwiSaver and what contribution rate is therefore required?

What is the value of advice?

Unfortunately, due to the relatively late adoption of a universal retirement savings scheme, research on the benefits of advice in New Zealand is scarce. However, in more mature markets such as the United States there is a wealth of knowledge based on over a generation of experience in saving for retirement.

These studies have found, amongst other things, that unadvised clients are likely to be overinvested in a single asset (undiversified) or not invested in growth assets at all (non-participating) (Calvet; Campbell and Sodini, 2007).

Advised clients, on the other hand, earn higher returns after fees mainly because their asset allocation is better over the investment lifetime (Foerster, Linnainmaa, Melzer, Previtero, 2014).

As a consequence, research shows financially planned clients accumulate nearly 250% more retirement savings than those without a financial plan (“The Future of Retirement” HSBC 2011). Little wonder then that a survey in 2014 by IRI, which was also written up in Forbes Magazine on 28 August 2014, noted that baby boomers with a financial adviser are twice as likely to be confident about their retirement than those without an adviser.

How are advisers remunerated?

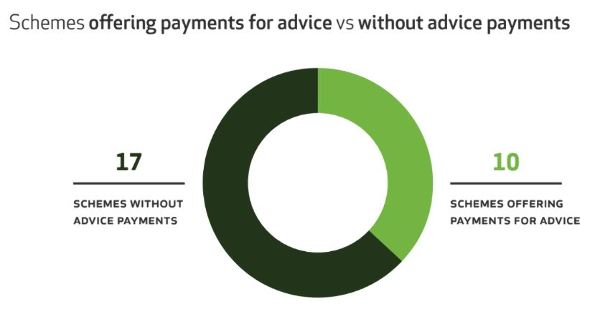

10 of the 27 KiwiSaver schemes in New Zealand (37%), are structured for advisers to be able to work with scheme members, either through an upfront planning payment, or through an annual payment, or both.

In most cases the cost of advice is funded by the manager out of its management revenues. Through facilitating advice to accompany their product, these schemes offer a fundamentally different service.

There is of course no value in clients paying for something they do not want, or worse, want but do not receive. Unfortunately there are examples of both in our small market. It would however be helpful for both the Commission for Financial Capability and FMA to distinguish between “advised” and “non-advised” schemes when categorising the options available for New Zealanders in online tools like Sorted and the “KiwiSaver Tracker”.