New expenditure guidelines show how much New Zealanders need in their KiwiSaver to retire comfortably.

Kiwis who want the odd luxury in retirement need between $273,000 and $1.033 million on top of superannuation, according to the latest Retirement Expenditure Guidelines. For a more modest 'no frills' retirement, they would need between $118,000 and $181,000.

Financial Advice NZ chief executive Nick Hakes says advisers are more needed than ever to help New Zealanders get there.

Released by Massey University's Fin-Ed Centre, the guidelines are based on actual spending patterns of retired New Zealanders who receive superannuation. The report shows a weekly expenditure of $705-$1,780 depending on household type and location – well above what superannuation provides.

The savings gap

As of April 2025, a single person living alone receives $538.42 per week on superannuation. Total expenditure for the ‘no frills – metro’ category is $705.34. This trend extends to every type of household.

In short, everyone is spending more than superannuation would give them.

To bridge the gap, a one-person household would need to save between $71 – $218 weekly from age 25, depending on lifestyle and location. From age 50, those figures increase to $54 – $325 weekly.

A two-person household would need to save up to $406 weekly from age 25, and up to $1,230 from age 50.

At the same time, retirees are spending more on essentials. Property rates jumped 11.9% and household energy costs rose 9.1% – well above the 2.7% general inflation rate.

Hakes says that clients can often find these large numbers daunting, so they defer decision making until the last moment.

“That’s when clients and advisers say “I wish you had started sooner.” The key message is that the earlier people can start working with an adviser, the better financial position they’ll be in, and those big retirement numbers won’t be so daunting,” he told Good Returns.

“Year in and year out, the research highlights that relying on superannuation alone is not enough. Financial advisers can help calculate the savings that are needed, targets, and plans to reach it – and most importantly, how that adjusts over time as circumstances change.”

How far off-target are New Zealanders?

The report models a range of scenarios, and shows that someone who starts contributing to KiwiSaver in their 20s could still reach the ‘no frills’ target, even after a $75,000 withdrawal for a first-home deposit at age 35. However, those joining KiwiSaver in their 40s or 50s or who pause contributions for a few years have more of an uphill battle.

Hakes says that having a strategy is a starting point, but you also need to stick to the plan.

“Having the KiwiSaver is a good start, but there’s so much more to it,” he says.

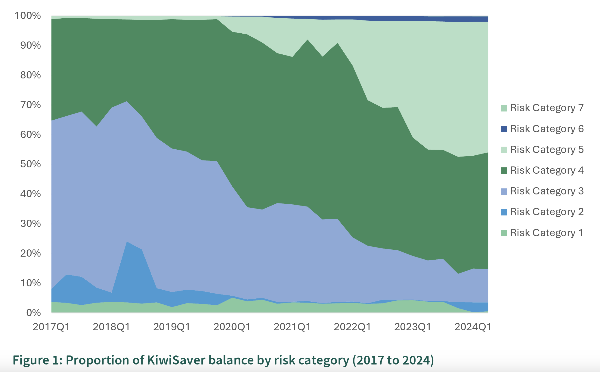

“How it changes over time, whether you’re in the right fund, how the environment is impacting investment returns, etc. It’s so much deeper and broader than just “here’s the financial product.”

“We know through research that people with financial advisers are feeling more prepared and confident about retirement,” he adds. “One of the reasons we’ve signed the MOU with the retirement commission and the Sorted platform is to create a pathway from financial information to financial action.”

Bridging the advice gap

Household living costs are increasing, and KiwiSaver has seen record numbers of hardship withdrawals this year – $443.6 million, up by 51% on 2024. Hakes says that this is a concern for this industry, where withdrawals are seen as an absolute last resort.

Given the impact of a first-home deposit withdrawal, Kiwis can’t afford to take more out of their KiwiSavers early.

For advisers, there’s plenty of opportunity to educate, and a whole new generation moving towards the magical line of 65.

“Even millennials are well and truly in the workforce now,” Hakes says.

“If advisers who have been traditionally providing advice to clients who are just on either side of that 65, now is absolutely the time that intergenerational thinking needs to take place. That’s also about broadening the scope of advice, and that’s what adviser businesses should be thinking about – on a client level, a technical level, and on a business level.”